Budget planner biweekly pay how to#

It takes time to not only stick to a budget but learn how to make a budget that works for you. It’s not uncommon to write a budget that you think is perfect only to find that you’ve blown your budget within a week of payday. By tracking your expenses and spending, you’ll get a good idea of whether or not your budget is realistic. Once you have your biweekly budget written, it’s important to track your spending. Biweekly Budget Step 5: Track your spending. If there is any leftover money after accounting for all your expenses, send it to savings or debt. Step 4: Write your second biweekly budget.Īfter your second check has hit your bank account, then you can pay the rest of your bills for the month. You’ll also need to set aside money for groceries, gas, and other expenses.ĭon’t forget to include these 10 items that are most commonly missing from budgets!

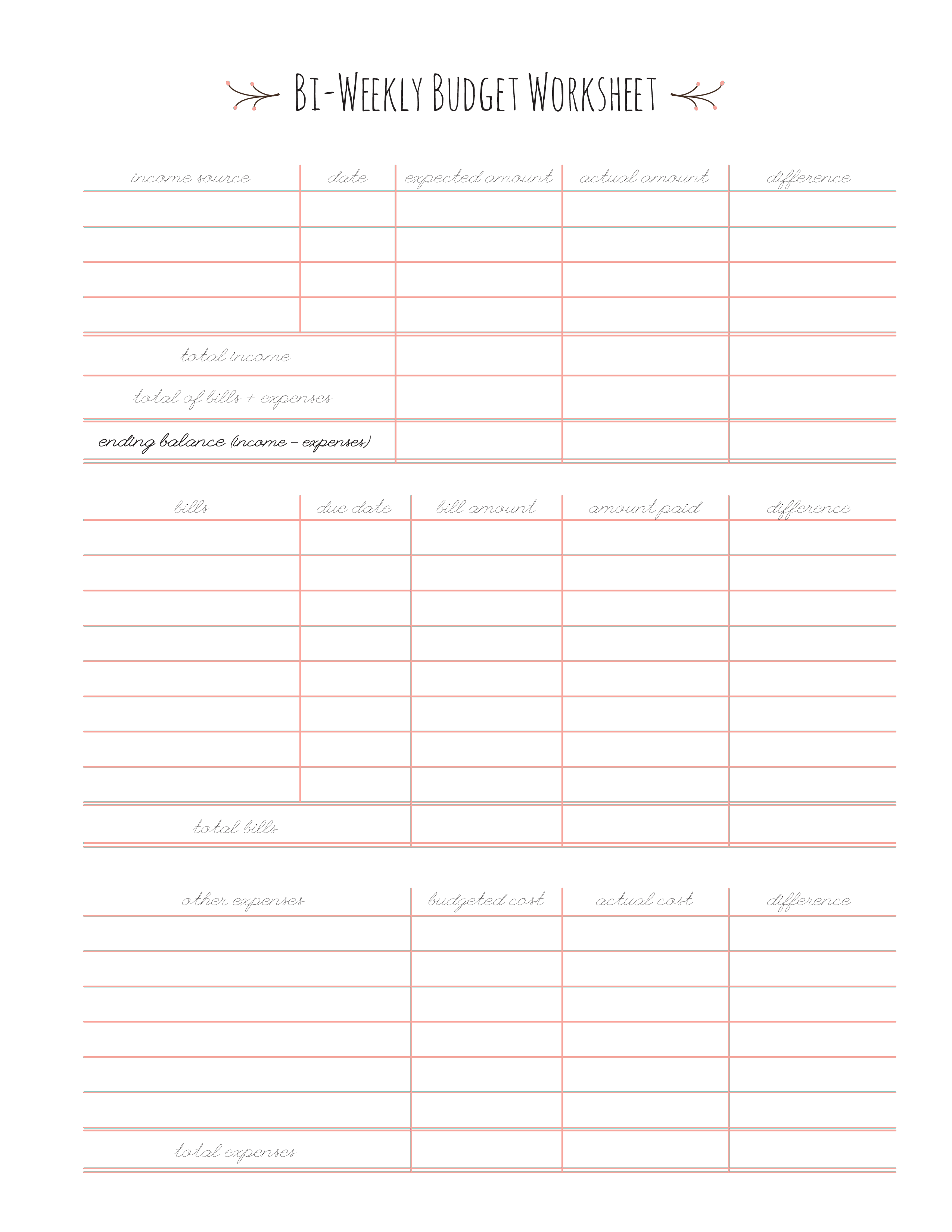

If you have any money left over, you can send it to your sinking funds or make an extra payment toward debt! This will help you reach your savings and debt freedom goals faster.įor my biweekly budget planner, I use the one from my Budget Life Planner. Be sure to include every expense you’ll have before your next payday.īy creating a thorough budget, you’ll be setting yourself up for success! Next, add any extra expenses into your budget, such as groceries, gas, and spending money. Once you’ve filled out your bill payment calendar, you’ll know which bills need to be paid with your first paycheck. A bill payment calendar is the perfect way to keep yourself organized and make budgeting biweekly an easy task! Step 3: Write your first biweekly budget. My favorite place is right on the fridge in the kitchen. Don’t tuck it away, or else you might forget to reference it throughout the month. Keep your bill payment calendar somewhere you can refer back to it often. Otherwise, those gifts or special dinners will eat up other parts of your budget! This will ensure you remember to include any extra expenses for the holiday in your upcoming budget. For instance, add any family’s birthdays or holidays to your bill payment calendar.

This way, you know which bills will be paid automatically and which ones you are responsible for manually paying.Īnother great tip is to add other notes or special dates to your bill payment calendar to help you with your budget. You can even draw an asterisk next to every bill that will be automatically drafted out of your account. I always put a checkmark next to each bill after I’ve paid it or after it has been automatically drafted from my account. Then, highlight all the bills that will come out of your second paycheck with another color.īill payment calendars are perfect for tracking when you’ve paid bills. If you’re a visual person like me, then this is a must!Ī simple monthly calendar will work, or you can use this biweekly budget template from my Budget Life Planner.Īs you write your biweekly budget, highlight all the bills that will be paid from your first paycheck with one color. This type of calendar helps you organize your bills based on when they are paid. Once you’ve listed out all your bills, it’s time to add them to your Bill Payment Calendar. So, the more prepared you are with your budget, the more likely it is to work! Biweekly Budget Step 2: Create your bill payment calendar. Although no system will be perfect, this is when so many people give up on their budget plan. If you forget to add a monthly expense to your list, your entire biweekly budget can be thrown off. Go through every transaction and highlight the bills that come out every month. To ensure you don’t miss any bills, print out your last two months’ bank statements. Grab a piece of paper and list out all your bills, the amount due, and their due dates. However, no matter if you are paid biweekly or twice a month, the following steps will help you write a budget that you can stick to! Biweekly Budget Step 1: List out your bills.

They won’t have the opportunity to enjoy those third paycheck months. Those who are paid twice each month will only receive 24 paychecks. Is biweekly pay the same as getting paid twice a month?īiweekly pay isn’t the same as getting paid twice each month. Wondering what you should do with this third paycheck? Don’t worry! We will cover that in this article.

Most months, you will receive two paychecks, but two months out of the year, you will receive three paychecks. If you are paid biweekly, you will receive 26 paychecks throughout the course of the year. A post shared by Allison Baggerly What is biweekly pay?

0 kommentar(er)

0 kommentar(er)